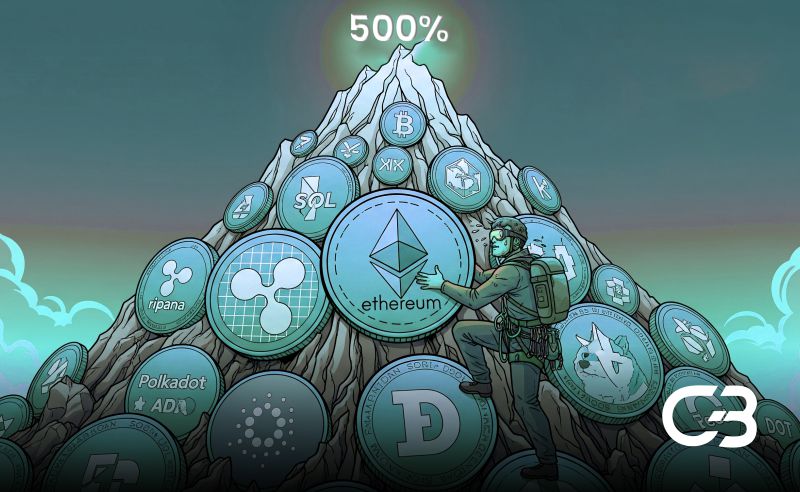

- The top crypto assets are experiencing record highs with more than 500% increases recorded in recent trading sessions.

- Both new and old projects present attractive strategic accumulation potential.

- Market trends underline the increasing importance of innovation and developer involvement in price performance.

Market data reveals a remarkable surge in several leading cryptocurrencies as traders closely monitor emerging trends. Prices for top digital assets have jumped sharply, reflecting robust trading volumes and rising market attention. Among the leading performers are Cardano (ADA), Solana (SOL), Ethena (ENA), Sui (SUI), XRP (XRP), and Arbitrum (ARB).

These assets have shown extraordinary endurance and activity on the trade, signifying a rising attention to initiatives with robust frameworks and prolonged prospects of integration. Analysts point out that such performance highlights the dynamic structure of the crypto market, where sometimes the volatility leads to strategic accumulation possibilities.

Exceptional Market Performance of Cardano (ADA)

Cardano has been maintaining a high level of trading activity, with its price steadily growing, and developer activity on the rise. The project has been performing very well and has experienced an appreciable growth rate because they have increased in implementing their smart contracts. Industry analysts observe that the market trend of ADA indicates that more people believe in systems that accommodate decentralized applications, which is a founding principle of its existence.

Groundbreaking Gains in Solana (SOL)

It is impressive that Solana has gained momentum in recent times due to increased transaction volumes and ecosystem growth. Analysts refer to the movement of SOL on the market as a phenomenal process, indicating network efficiency and developer adoption. Investors who pay attention to price dynamics in the short run understand that SOL is indeed an elite digital asset that offers the prospect of rewarding trading based on technical analysis of the market.

Innovative Moves in Ethena (ENA)

Ethena has experienced unmatched upward momentum, featuring its innovative architecture and growing client base. Its performance has been described as groundbreaking and unparalleled in the recent market cycles. The increasing liquidity and frequency of trading in ENA suggest that this environment is potentially profitable to participants, the key to understanding which is paying attention to emerging cryptocurrencies and established ones alike.

Stellar Momentum in Sui (SUI)

Sui shows stronger growth trends, indicating larger market involvement and uptake in various decentralized areas. According to the analysts, the performance of SUI has been unmatched, similar to the market overall trend in blockchain innovation. This trend in the asset demonstrates that newer projects provide attractive opportunities during times of market focus to leverage long-term portfolio accumulation.

Remarkable Performance of XRP (XRP)

XRP has demonstrated optimal stability, with an acceptable growth rate, due to constant network activity and active institutional buy-in. Its performance has been reported as phenomenal, whereby market observers attribute its unrivaled liquidity and consistent trading volume. The price movement of XRP can be attributed to the fact that it is a safe digital asset that provides high-reward trade and a stable reference point among market players.

Lucrative Momentum in Arbitrum (ARB)

Arbitrum enjoys superior upside momentum based on increasing adoption in decentralized applications and broad developer support. ARB’s historic performance is what analysts call it, pointing to its unique layer-2 architecture that optimizes transactions. That harmonious combination of technology and adoption makes ARB a lucrative option for investors seeking premium opportunities in the rapidly growing cryptocurrency market.