Cryptocurrency has become a component of most estates and requires special planning to pass down. Unlike other traditional assets, digital currencies are based on the use of private keys. Inheritors can never possess these holdings without preparation.

Challenges of Crypto Inheritance

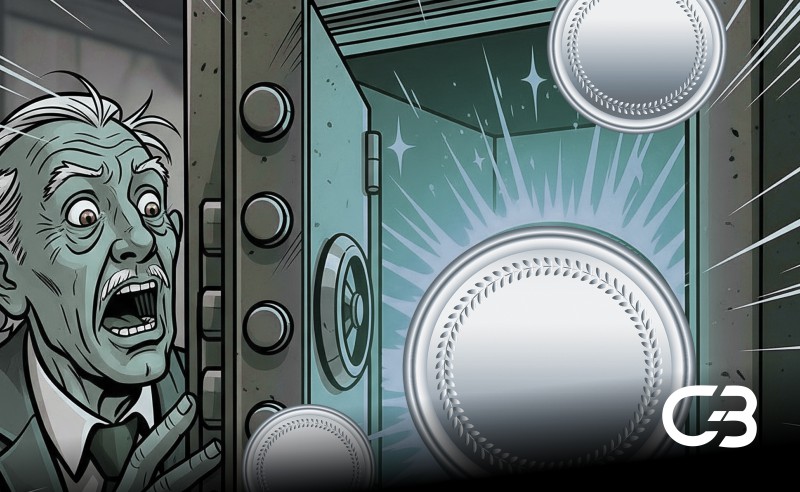

Access is the most urgent problem since coins would not be accessible to heirs without private keys. Cryptocurrency is decentralized, and there is no way traditional institutions can interfere. Families can lose information permanently when the essential information is lost.

Crypto inheritance is associated with a few urgent challenges:

- Access Problems: Heirs cannot control wallets and money without possessing private keys.

- Volatility Risks: Due to delays, market prices may decrease rapidly, losing value.

- Lacking Clarity: The digital sector’s wealth transfer laws are not uniform across the globe.

- Security Dilemmas: The key risk is to share too early, as you may get stolen, and the other key risk is to keep the secret forever, which is one-way.

- Procrastination: Most owners do not plan, which leaves heirs in a state of uncertainty.

These issues are also usually closely related. Late probates, for example, may increase volatility risks, and vague legislation may result in conflict. As a result, the owners need to face all these issues collectively, not individually.

How to Protect Wealth Beyond Your Lifetime

Protecting digital assets in case of death requires an orderly approach. It encompasses risk planning for technical risks, legal risks, and family conflicts. Hence, business owners must develop effective measures to cushion wealth even after death.

Planning with Beneficiary Designations

Certain exchanges have now permitted users to name beneficiaries directly. This option operates in the same way as a conventional transfer-on-death to bank accounts. It will be distributed quickly and without going to court.

Nonetheless, it is not available on all platforms. The designation systems are not usually built in a private wallet, which consequently requires owners to maintain a detailed record of future heirs’ wallet access.

Thus, it is common to get written instructions regarding beneficiaries. Legal names, contact details, and evidence of relationship should be documented. This information minimizes conflicts and makes executors work confidently.

Using Trusts for Digital Assets

Another safe way of planning inheritance is to use trust structures. During their lifetime, owners have the option to transfer crypto in a revocable trust. This setup does not go through probate and also ensures that assets are given out as per instructions.

A trust is an exercise of careful handling of personal keys. Trustees need knowledge of the technical requirements and guard recovery phrases. However, the resources may be unavailable without technical expertise.

Therefore, one should choose an effective trustee who possesses sufficient knowledge regarding the law and online property. When used properly, trusts introduce stability to the benefactors.

Practical Storage and Recovery Methods

Owners use various methods to store keys. Some use paper backups, whereas others use hardware wallets or encrypted drives. Both approaches have peculiar advantages and disadvantages.

Physical means can be ineffective in case of disasters or robbery. Digital storage, on the other hand, is exposed to hacks or corruption. Thus, solution combinations enhance resilience and reliability.

Smart devices like dead man wallets or multisig switches are also safe. These procedures permit automatic release or shared approval of transactions, providing heirs with systematic access without security exposure.

Legal Considerations and Final Steps

Estate planning has a will. Crypto holdings should be explicitly mentioned in legal documents by their owners so that they are recognized in light of national laws.

The executors should follow the legal steps when approaching exchanges. In some parts of the world, computer misuse laws may be violated by unauthorized access. Thus, formal applications and court authorization are required for death certificates.

Lastly, periodic updates are necessary. The policies of storage, exchange, and asset values vary with time. Constant examination will ensure that the descendants inherit wealth in the right way.

Conclusion

Inheritance of cryptocurrency is complicated yet solvable through appropriate planning. Clarity, security, storage, and legal requirements protect online riches to successors. This will allow the owners to defend their assets and make the legacy transfer easier by doing it before it is too late.